Last updated on November 10th, 2025 at 10:07 am

9 August 2024|Best Buy Credit Card

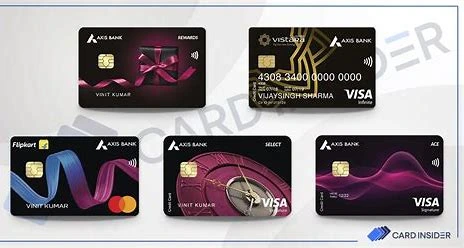

Discover the Axis Bank Credit Card: Your Best Financial Companion

In the hustle and bustle of daily life, having the right credit card isn’t just about convenience—it’s about making smart choices that work for you. If you’re on the lookout for a card that offers real value, let me introduce you to what I consider the Best Buy Credit Card—the Axis Bank Credit Card.

Why I Recommend the Axis Bank Credit Card

Let me share why I’m so enthusiastic about this card. For starters, I’ve found that the rewards program is genuinely rewarding. Every time I swipe my Axis Bank Credit Card, whether for a grocery run or booking a flight, I’m earning points that actually add up. It feels great knowing that even my everyday purchases are helping me save for something special.

But it’s not just about points. What really sets the Axis Bank Credit Card apart for me is the exclusive deals. Last month, I was able to snag a great discount on a much-needed gadget, simply because I paid with my Axis card. It’s moments like these that make me realize how much of a difference the right credit card can make.

Making Life Easier with Flexible Payments

We all know that life can throw some unexpected expenses our way. That’s where the flexible payment options with Axis Bank come in handy. I appreciate how easy it is to convert large purchases into manageable EMIs with low-interest rates. It’s like having a financial safety net, just in case.

And let’s talk about peace of mind—knowing that every transaction is protected by top-tier security features means I can shop online without a second thought. For me, that’s priceless.

How to Get Started

Applying for the Axis Bank Credit Card is refreshingly simple. I got twoBest Buy Credit Cards for you.

Table of Contents

ToggleAxis Vistara Platinum Credit Card

You can get Complimentary Economy Class domestic Vistara flight ticket

Complimentary Club Vistara base membership

Upto 3 free Economy domestic tickets on milestone spends

2 complimentary lounge visits per annum at select domestic airports & Much More!

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

Income: Rs 50,000 per month (Salaried), Rs 60,000 per month (self-employed)

Required Age: 21-65 years

Axis Indian Oil Credit Card

You can get 100% Cashback up to Rs 250 on all fuel transactions in first 30 days

20 reward points per Rs 100 spent at IOCL pumps across India

1% fuel surcharge waiver

Annual fee waiver of Rs 50,000 & Much More!

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

Income: Rs 15,000 per month (Salaried), Rs 30,000 per month (self-employed)

Required Age: 21-60 years

Final Thoughts

If you’re someone who values both convenience and rewards, the Axis Bank Credit Card might just be your new best friend in the financial world. It’s not just the best credit cardI’ve used—it’s a tool that makes managing my money a little more enjoyable.

So why not give it a try? You might find that this card is exactly what you’ve been looking for.

FAQ: Credit Cards

1. What is a credit card?

A credit card is a financial tool issued by a bank or financial institution that allows you to borrow funds to make purchases. You repay the borrowed amount, often with interest, if you carry a balance.

2. How do credit cards work?

Credit cards let you make purchases up to a pre-set credit limit. Each month, you receive a statement detailing your balance and minimum payment due. Paying in full avoids interest, while carrying a balance accrues interest.

3. What is the difference between a credit and debit card?

A debit card pulls funds directly from your bank account, while a credit card allows you to borrow funds with the agreement that you’ll repay them later, often with interest if the balance is unpaid.

4. What are the benefits of using a credit card?

Credit cards offer rewards, cash back, purchase protection, & often extended warranties on purchases. They also help build credit history when used responsibly, which can improve access to loans and better interest rates.

5. What is APR, and how does it affect my credit card?

APR (Annual Percentage Rate) is the interest rate applied to any unpaid balance on your credit card. A lower APR means you pay less interest on carried balances, while a higher APR can lead to more interest charges if you don’t pay in full.

6. What is a credit limit?

Your credit limit is the maximum amount you can charge on your card. Staying within this limit is crucial for maintaining a good credit score. Exceeding your credit limit can result in penalties and harm your credit score.

7. What does “minimum payment” mean?

The minimum payment is the smallest amount you can pay each month to keep your account in good standing. However, paying only the minimum means you’ll pay more in interest over time and take longer to pay off the balance.

8. How does a credit card impact my credit score?

A credit card impacts your score based on factors like payment history, credit utilization, account age, and types of credit. Responsible use improves your score, while missed payments and high balances can lower it.

9. What are rewards credit cards?

Rewards cards offer points, cash back, or travel miles for every dollar spent. These rewards can be redeemed for goods, services, or travel, and are a popular feature for those who pay off their balance each month.

10. What is credit utilization, and why does it matter?

Credit utilization is the percentage of your credit limit you’re using. Keeping it under 30% is ideal for a good credit score. Higher utilization can negatively affect your score by suggesting a reliance on credit.

11. Can I have multiple credit cards?

Yes, you can have multiple credit cards. However, managing multiple cards responsibly requires careful tracking of due dates and balances. Multiple cards can help your credit score by increasing total credit available, if well-managed.

12. What happens if I miss a payment?

Missed payments can result in late fees, penalty APR increases, and damage to your credit score. Multiple missed payments can have a long-lasting negative impact on your credit report.

13. How can I avoid paying interest on my credit card?

To avoid interest, pay your balance in full by the due date each month. Many cards offer a grace period (usually around 21 days), during which no interest is charged on new purchases if you have no carried balance.

14. What is a balance transfer, and when should I consider it?

A balance transfer involves moving a balance from one credit card to another, often to a card with a lower interest rate. It’s useful if you’re looking to pay off debt faster, but be mindful of any transfer fees.

15. What is a secured credit card?

A secured credit card requires a cash deposit as collateral, making it a good option for individuals with low or no credit history. Responsible use of a secured card can help build or repair credit.

16. Are there fees associated with credit cards?

Yes, fees may include annual fees, late payment fees, cash advance fees, foreign transaction fees, and balance transfer fees. Reviewing these fees when choosing a card helps you pick one that fits your financial needs.

17. Can I use a credit card abroad?

Yes, most credit cards are widely accepted internationally. However, many cards charge a foreign transaction fee for purchases made outside your home country. Some travel cards offer no foreign transaction fees, which is beneficial for frequent travelers.

18. What is a credit card cash advance?

A cash advance lets you withdraw cash from your credit card, but it typically comes with high fees and interest rates. Cash advances start accruing interest immediately, unlike regular purchases, which may have a grace period.

19. How can I protect myself from credit card fraud?

Monitor your statements regularly, avoid sharing your card information, and use secure websites for online purchases. Report lost or stolen cards immediately, and consider setting up alerts for unusual account activity.

20. How do I choose the right credit card?

Consider factors like interest rates, fees, rewards, and your spending habits. A card that matches your lifestyle and financial goals is the best fit, whether it’s a rewards card, low-interest card, or secured card for building credit.

21. Can I pay my credit card bill with another credit card?

Typically, no, credit card issuers don’t allow direct payments from another credit card. However, a balance transfer to a different card is an option, though this may involve fees and a potential impact on your credit score.

22. What is an introductory APR offer?

An introductory APR offer is a lower interest rate (sometimes 0%) for a set period when you open a new card. After the period ends, the APR returns to the standard rate, so it’s best to pay off balances before this offer expires.

23. How does closing a credit card affect my credit score?

Closing a credit card can lower your score by reducing your available credit and potentially affecting your credit utilization ratio. It can also shorten your average credit age, so consider keeping accounts open if they have no annual fees.

24. What should I do if I can’t pay my credit card bill?

Contact your credit card issuer to discuss options. Some may offer hardship programs, lower interest rates, or payment plans. Ignoring the bill can lead to fees, increased interest, and damage to your credit score.

25. How do credit card grace periods work?

The grace period is the time between the end of your billing cycle and the payment due date. If you pay your balance in full during this time, you avoid interest on new purchases. However, carrying a balance may mean losing this grace period.

Credit Cards

Top Deals

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!